Explore strategic avenues to navigate around US worldwide taxation without breaching any laws.

Understanding US Worldwide Taxation: The Basics

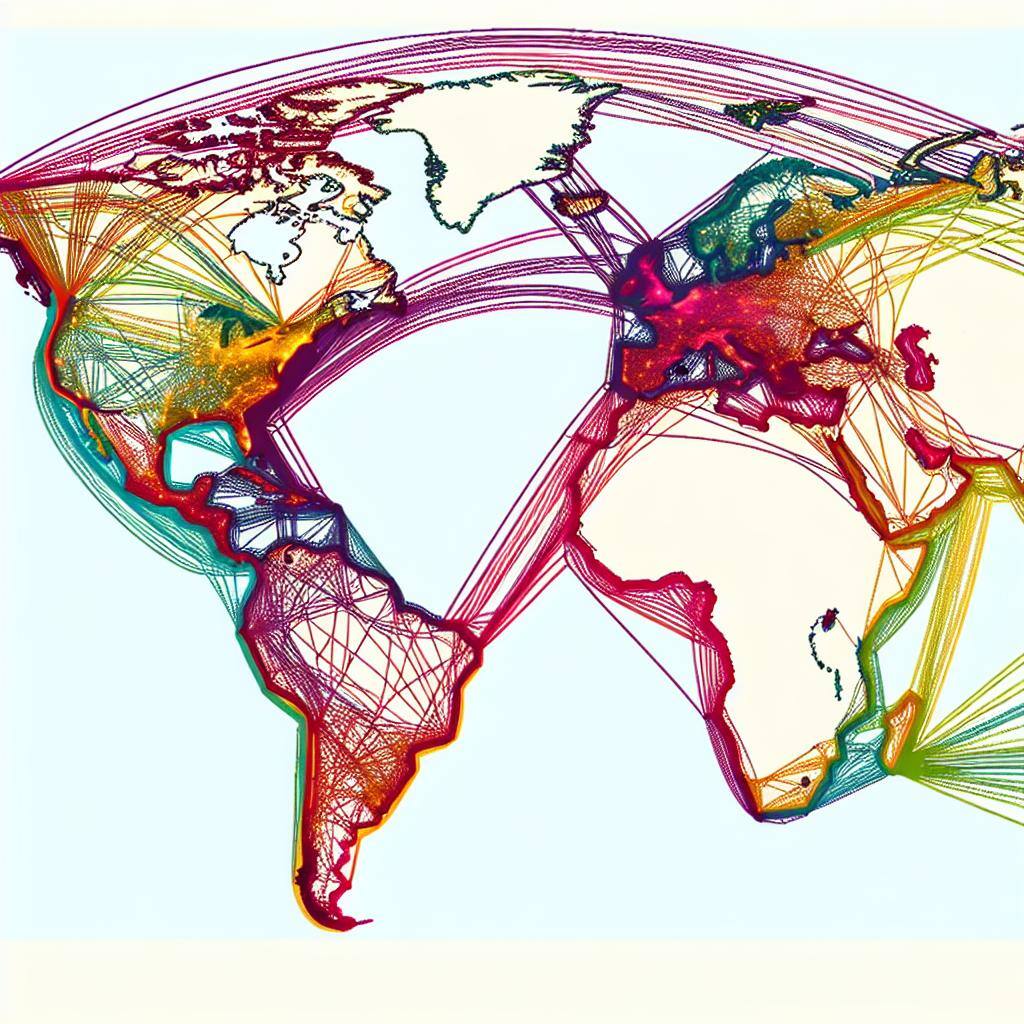

The United States is one of the few countries that tax its residents on their global income. All income earned by U.S. citizens and residents, regardless of where it is generated (including your income sourced in your home country) , is subject to U.S. federal income tax. Worldwide taxation applies to earned wages, business income, investment income, and even gains from the sale of property, among other types of income.

For those wondering how it works, the Internal Revenue Service (IRS) requires all U.S. persons to report their foreign income through tax returns. Taxpayers may be eligible for certain credits, such as the Foreign Tax Credit, deductions, such as the Foreign Earned Income Exclusion, and exclusions that can mitigate the burden of double taxation. Nonetheless, understanding the intricacies of these laws and how to comply with them is vital for anyone looking to manage their tax responsibilities effectively.

The Substantial Presence Test

The substantial presence test connects you to the US resident status based on the number of days you have been present in the U.S. You need to know your number of days in presence in the U.S. for a three-year period.

Once you become a US tax resident with this test, the IRS taxes your worldwide income from the current year. Most people in the U.S. meet this test even if they do not have US citizenship or a permanent residence card (Green Card.) It becomes tough for such individuals to avoid worldwide taxation. US citizens and permanent residents have also no way out. They are always (even if they do not physically live in the U.S.) subject to US worldwide taxation based on their status.

Therefore, if you plan to be in the U.S. for a longer period of time, and do not wish to obtain a Green Card nor US citizenship, this article may give some hints.

Qualifying as an Exempt Individual: A Gateway for Students and Teachers

An 'exempt individual' for tax purposes in the U.S. is someone whose days in the United States are not counted toward the Substantial Presence Test, potentially exempting them from being classified as a resident for tax purposes. Students, teachers, and trainees temporarily present in the U.S. under 'F,' 'J,' 'M,' or 'Q' visas may qualify for this exemption. One must prove they are in the U.S. primarily for educational or vocational reasons to benefit from this designation.

Other examples of exempt individuals include government-related individuals, such as diplomats, and professional athletes competing in charitable sporting events. Let's focus on students' or teachers' status in this article, as they are the most common groups that may benefit from these tax exemptions.

This exempt status of students and teachers allows them to exclude their foreign income from U.S. taxation. First, you must have a valid visa and meet the tax filing requirements. To avoid US worldwide taxation, you cannot permanently be a student or teacher. There is a five-year time limitation. From the sixth year, you are no longer an exempt individual.

Even if you have foreign source income as a US resident, you will not get taxed by the IRS for the foreign source income if you are an exempt individual. To ensure you navigate these complex tax laws correctly, I strongly recommend consulting with CHI Border. Their expertise will provide you with the necessary guidance and reassurance.